Ever wonder why your finance campaigns aren’t scaling? Affiliate marketing in financial services looks great on paper, but many banks and fintechs struggle to make it work. Approval rates tank, compliance issues pop up, and ROI becomes a guessing game.

This article breaks down how successful financial advertisers use affiliate networks. We’ll cover what they expect, how they design offers, and the metrics that actually drive profit. Forget retail assumptions—this is how you win in a regulated, approval-based world.

Why do banks and financial brands use affiliate marketing?

Here’s the deal: banks, lenders, and fintechs use affiliate marketing as a performance channel, not a branding play. They’re not chasing impressions; they want approved, funded, or activated customers who meet their risk criteria.

In practice, they use it to:

Acquire qualified applicants at a predictable cost

Pay only for validated outcomes, like approvals or funding

Complement other channels with incremental reach

Test new products or geos with controlled risk

Scale distribution without hiring a huge sales team

Finance affiliate marketing isn’t top-of-funnel. It’s about converting high-intent users and measuring success by LTV, not just CPA.

What does an affiliate network actually do in finance?

In financial services, a network is more than just a traffic source. It’s a partner that manages the entire process, from tracking and compliance to payouts and fraud control.

Finance is complex. Conversions are approval-based, funnels are longer, and partner vetting is strict. A specialized network handles this complexity so you don’t have to.

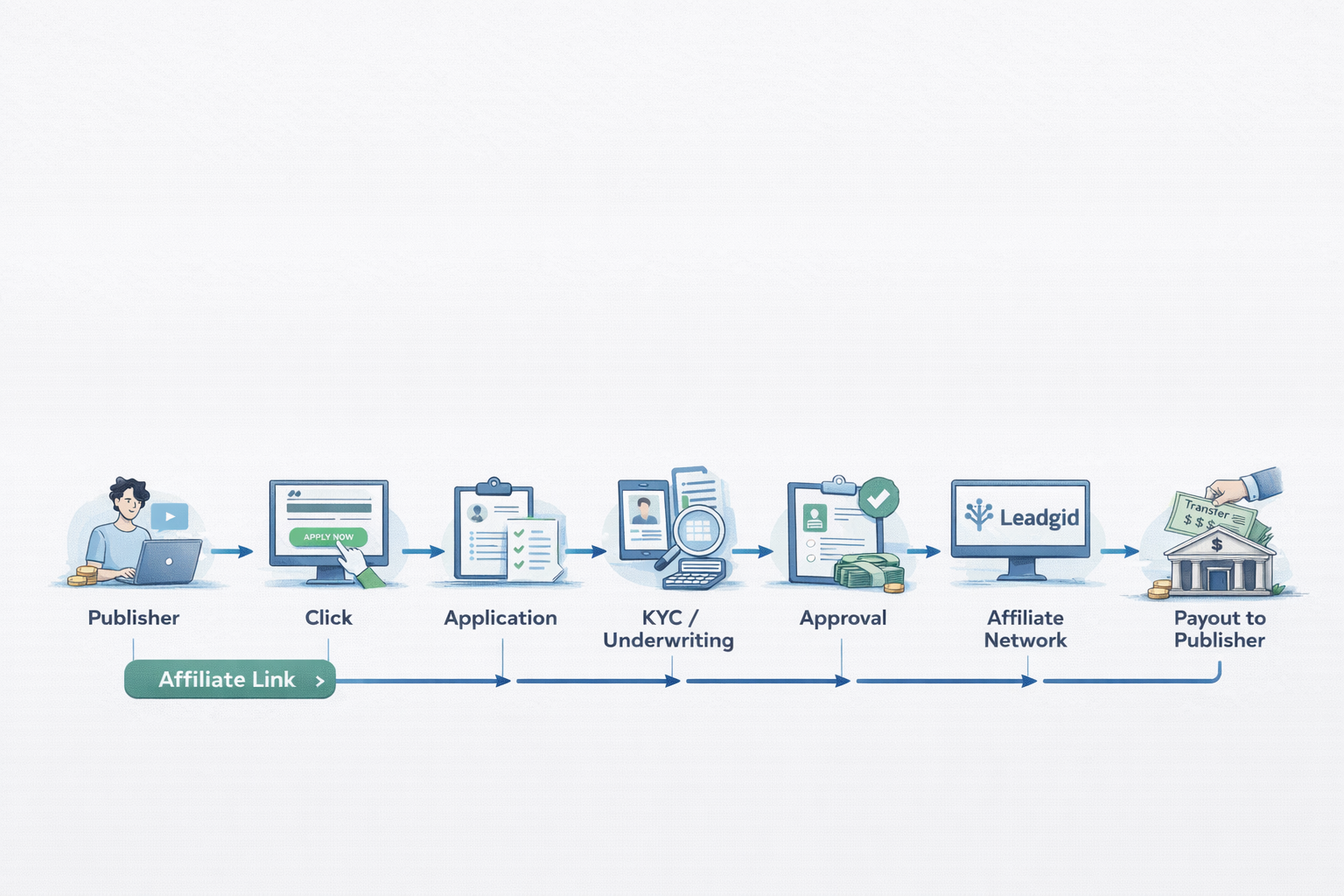

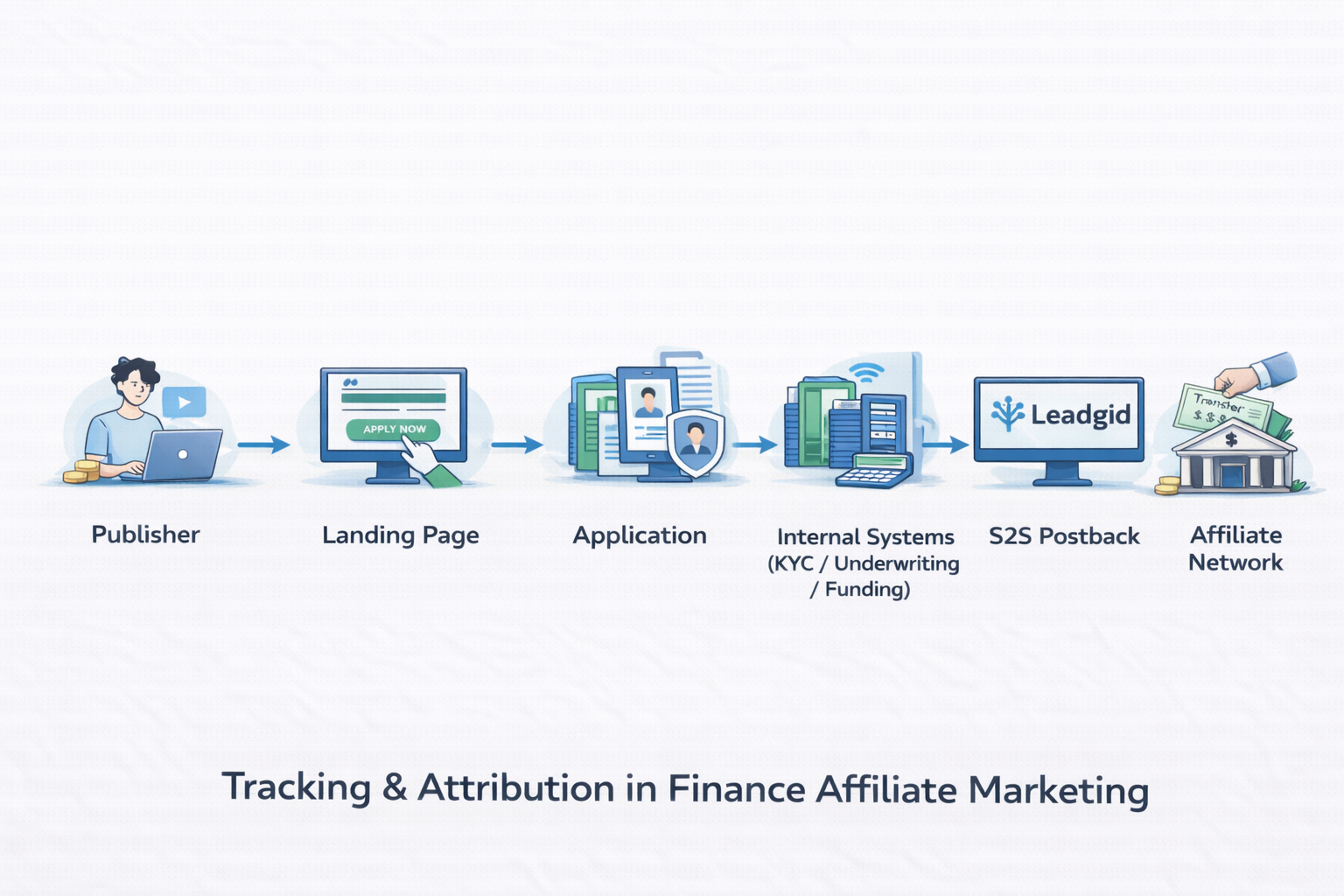

Here’s a look at the typical finance affiliate flow:

What do advertisers really expect from a CPA network?

Expectations in finance are sky-high. Advertisers aren’t just looking for “more traffic.” They want control, transparency, and results that align with their business goals.

Here’s what a financial advertiser expects from a CPA network:

Access to vetted, finance-capable publishers

Rock-solid tracking they can trust, including server-to-server postbacks

Clear attribution and deduplication against other channels

Transparent reporting tied to approvals and funding

Predictable clawbacks, reconciliation, and payment cycles

Networks that can’t deliver on these fundamentals create volume without confidence. That’s why finance-focused networks like Leadgid are the go-to choice for advertisers who prioritize transparency and performance.

How should you design finance offers that actually convert?

Here’s a simple rule: design offers backward from value, not from traffic volume. Different products have different conversion points, and paying too early just shifts risk to the advertiser and brings in low-quality leads.

Here’s a quick breakdown:

Credit cards → Approved application

Banking → Open + funded account

Investing → Funded account or first trade

Insurance → Policy bind

Lending → Approved or qualified application

How do you handle compliance and brand safety?

Compliance isn’t a separate step; it’s built into everything you do in finance affiliate marketing. Get it wrong, and you’re looking at serious trouble.

Here are the non-negotiables:

No misleading or guaranteed claims. Period.

Accurate APR, fee, and eligibility disclosures.

Clear affiliate disclosures.

Approved creatives and placements only.

And here’s how you enforce it:

Pre-launch reviews of all creatives and landing pages.

Automated monitoring and spot checks.

Documented escalation and takedown timelines.

Clawbacks and penalties when needed.

Most serious failures in finance affiliate pro

grams are compliance-driven, not performance-driven.

How do you get tracking and attribution right?

Without solid tracking, ROI reporting is just guesswork. Here’s how to get it right:

Use server-to-server postbacks for approvals, funding, and activation.

Maintain persistent click IDs through the entire funnel.

Set defined attribution windows for each event.

Deduplicate against other channels to ensure you’re not paying twice.

Import offline approvals from a CRM or call tracking system.

What types of publishers work best in finance?

Different publisher types bring different kinds of value. For example, comparison sites are great for high-intent users who are ready to make a decision, while pay-per-call publishers can deliver highly qualified leads. The key is to have clear briefs and approval workflows to reduce risk and improve conversion quality.

How do you prevent lead fraud?

Fraud prevention requires constant monitoring and enforcement. Here are the key risks and how to control them:

Bots: Use device and velocity checks.

Duplicate leads: Maintain suppression lists.

Incent abuse: Implement staged payouts.

Call spam: Use duration and routing filters.

Sub-affiliate abuse: Require transparency.

What metrics actually matter?

Forget vanity metrics. Here’s what you should be tracking:

Approval rate: Shows lead quality and is crucial for core efficiency.

Funded / bind rate: Measures real value and revenue alignment.

Activation time: Highlights funnel friction and opportunities for optimization.

LTV : CAC: Determines unit economics and scalability.

Clawback rate: Indicates risk and overall program health.

Ready to Scale Your Finance Campaigns?

If you’re ready to grow your finance vertical with a partner that understands the market, it’s time to connect with Leadgid. Get access to top GEOs, exclusive offers, and expert support.

👉 Register at Leadgid and start scaling smarter.