When affiliates talk about where the real growth is happening, LATAM is always on the list. With more than 669 million people and around 80% internet penetration, the region combines huge scale with an audience that loves to play. Traffic costs are still lower than in Tier-1, and iGaming is steadily gaining traction.

To succeed here, you’ll need more than just traffic. First, work with a trusted partner and a brand players actually recognize. Second, focus on strategies and funnels that have been tested and are actual. And third, always keep two perspectives in mind: what generally works across LATAM, and what specifically works in each country.

In this guide, PIN-UP Partners breaks down everything you need to know: the region’s top GEOs, proven traffic sources, and funnel strategies that actually bring results. By the end, you’ll have a clear picture of where to start, how to optimize, and how to scale profitably.

Why Mexico, Chile, and Ecuador are the top GEOs in LATAM

Mexico, Chile, and Ecuador didn’t become LATAM’s top GEOs by chance. The region as a whole has all the right ingredients for iGaming growth: a young, active population, strong internet penetration, and an increasing appetite for gambling and sports betting. Within this context, these three countries stand out by delivering stable conversion rates and showing steady momentum in the iGaming segment.

Mexico impresses with its scale — a huge audience and a burning passion for betting make it possible to work confidently with large volumes of traffic. Chile brings something different to the table: a more affluent audience that places high trust in recognizable brands, which directly translates into better traffic quality and stronger retention. Ecuador may be smaller in size, but it more than compensates with low competition and rapidly growing interest in gambling.

Together, these factors make Mexico, Chile, and Ecuador the most attractive entry points for affiliates in 2025. They offer affordable traffic, predictable results, and plenty of room to scale. In the next sections, we’ll take a closer look at each GEO.

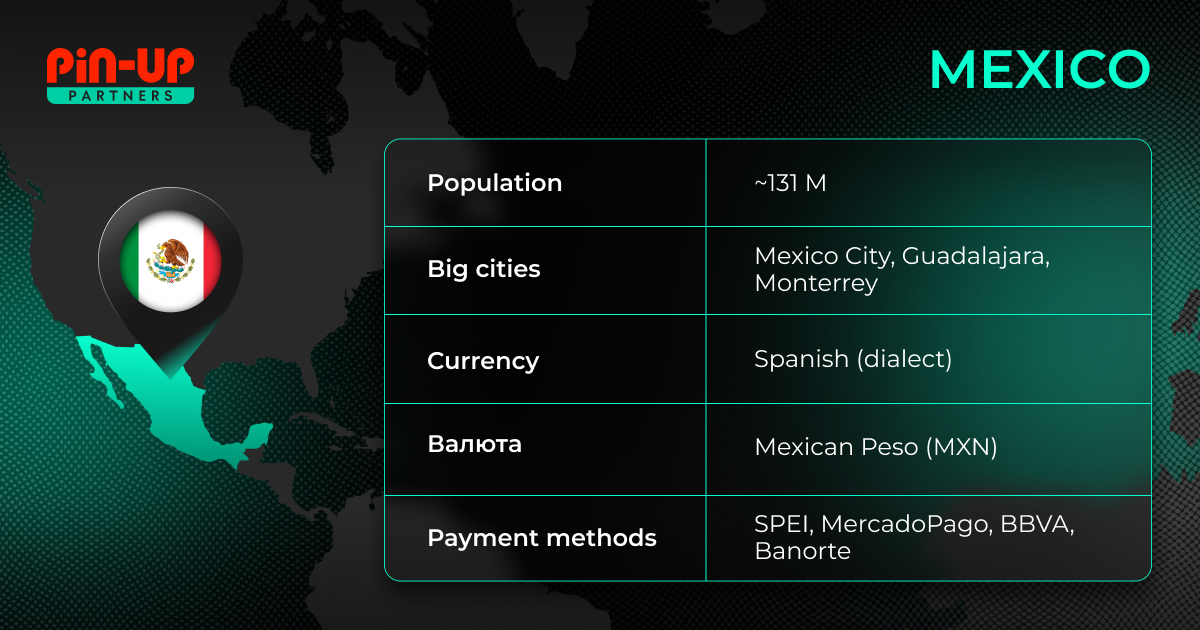

Mexico

Mexico stands out among other GEOs in Latin America for both scale and audience engagement. With a population of over 131 million mostly living in large cities, the country is highly digitalized, and attitudes toward gambling and betting are generally positive. Mexicans play their favorite slots/crash games and bet on sports tournaments with real passion driven by that famously fiery mentality.

Economy. The average monthly income is around $630. Offers with a low entry threshold and modest deposits (100–300 pesos or about $5.5–16) tend to perform best. At the same time, players value trust and stability, so transparent bonus terms and a straightforward payout system significantly increase the chances of repeat deposits.

Traffic. Mexico is a mobile-first market, with more than 86.51% of users accessing via Android devices. The most popular social platforms are Facebook (93M users), TikTok (85.4M), and YouTube (83.6M), all of which provide broad reach and strong engagement.

Attitude toward iGaming. Gambling is legal here and seen as a form of entertainment. The undisputed leader is betting, especially on football. The national Liga MX, big clubs like Club América and Chivas, and international tournaments consistently pull in huge, dedicated audiences. As for casino games, slots and crash titles dominate. One of the biggest local hits is Balloon, which has become a LATAM favorite in general. For affiliates planning to test crash approaches, Balloon is the ideal starting point.

Chile

Chile is another promising GEO with a solvent audience and near-total digitalization. The market is on the verge of full online gambling regulation, which makes it crucial to start shaping “white-hat” approaches right now.

Economy. Income levels are higher than the LATAM average: in 2025, it’s around $700–1000. This allows room to test slightly higher FDs, but the offer needs to be sweetened with strong bonuses, cashback, and other perks that resonate with players. As in other GEOs, users are very sensitive to clear payout processes and transparent terms.

Traffic. Internet penetration in Chile is incredibly high (≈94%), and the audience is primarily mobile-first. The most popular social media are Instagram, Facebook and YouTube. Video formats and UGC in social media work best here, consistently delivering results. To avoid losing traffic, landing pages should be lightweight and load quickly on smartphones.

Attitude toward iGaming. Online casinos are still officially banned, but regulation is on the horizon: in 2025, the Chilean Senate approved a bill on gambling and betting regulation in its first reading, and adjustments to the framework are now underway. Advertising rules remain strict (restrictions on sponsorships and promos), so the only safe option is white-hat creatives, local-language messaging, and a strong focus on trust (reliable providers and transparent bonuses).

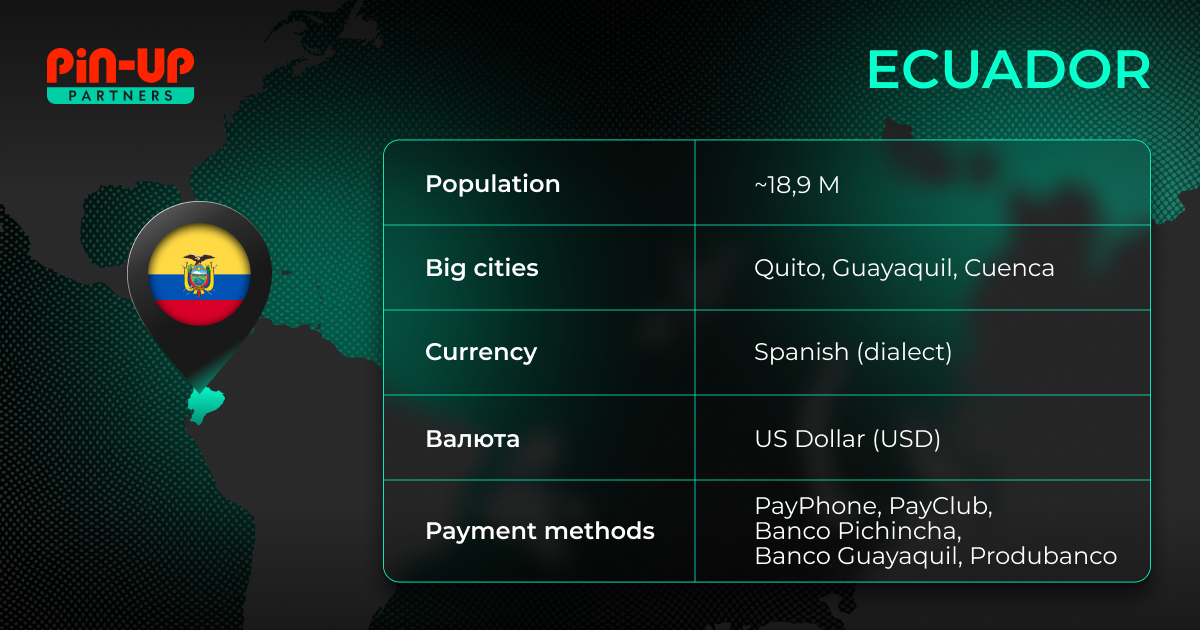

Ecuador

Ecuador is one of the newest and most promising Tier-3 GEOs in Latin America. Competition here is still low, and traffic costs remain cheap, making the market especially appealing for affiliates.

Economy. Ecuador has a powerful advantage that Mexico and Chile don’t: stability. Thanks to the country’s dollarized economy, there’s no risk of sudden currency swings. Payment systems are predictable, and both players and affiliates can easily deposit and withdraw in USD.

Traffic. Virtually all internet traffic comes from mobile. The top platforms are TikTok (12.66M users), Facebook (12.5M users), and YouTube (11.7M users), which boast exceptionally high engagement rates. That’s why PIN-UP Partners recommend starting with these sources right away.

Attitude toward iGaming. In Ecuador, players have fully embraced online gambling ever since land-based casinos were shut down back in 2011. With no offline options, digital platforms became the main stage, and that’s where the action still is. Casino traffic here converts especially well on slots and crash games like Aviator, Balloon, and Sweet Bonanza, since locals love high-volatility mechanics and quick rewards. On the betting side, it’s all about football: the national team, Copa América, and top clubs like Barcelona SC, Emelec, and LDU Quito drive the bulk of sportsbook activity.

Top converting traffic sources and approaches

The key to stable results in LATAM (specifically for Mexico, Chile and Ecuador) lies in choosing the right traffic source and building funnels adapted to local conditions.

The most effective traffic channels here are PPC, ASO, SEO, in-app, and influencer marketing. Facebook and Instagram, combined with UAC, deliver fast reach and flexible campaign settings. ASO brings in steady organic flows through branded and long-tail searches in the stores (with the main focus on Google Play, since Android dominates here). SEO with local domains remains a viable strategy, especially in countries where the industry is moving toward regulation. In-app traffic allows you to target already engaged users, while partnerships with local bloggers and streamers on YouTube or TikTok bring a high level of trust to the product.

Still, the FB + WebView/PWA bundle remains the go-to approach for most affiliates in those GEOs. It meets the core requirement: a light, fast funnel. Since most users go online from mid-range Android smartphones and often deal with unstable connections, every second of loading time matters. A pre-lander should weigh no more than 300–400 KB and open in one to two seconds. The WebView or PWA itself must stay lightweight (up to 1 MB) with an LCP under 2.5 seconds. Registration and the first deposit should take no more than a minute; any delays can cost up to 20% of users at each stage.

The golden rule for the region: the fewer steps and the clearer the local cues, the higher the CR. In practice, that means 20–30% of users complete registration → first deposit of $10–20. After that, LTV takes over, but it’s the short, simple funnel that determines whether a campaign hits profit right from the start.

Creatives and triggers are built on emotions and local symbols. Football, national pride, and holidays are evergreen themes in these countries. Bold visuals, large bonus figures, and UGC-style formats on TikTok and Facebook consistently generate strong engagement.

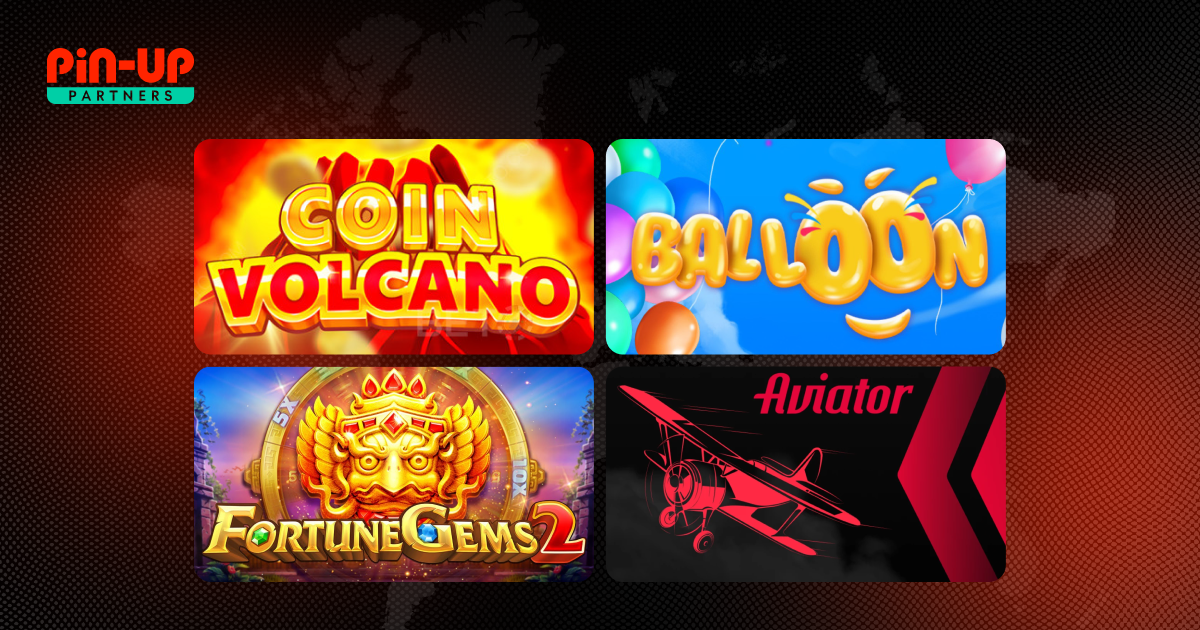

Slots, crash games, and live titles are the most in-demand across the region. Among the top performers are Fortune Gems 2 and Coin Volcano from JILI Games, Balloon from SmartSoft Gaming, and Aviator from Spribe.

In betting, football remains the key driver, but basketball and tennis are also popular while in Mexico, baseball deserves special attention as well.

There are also cultural nuances to consider. In Mexico, football clubs and Día de los Muertos resonate well, but the yellow color and even cat imagery are best avoided. In Ecuador, bonus mechanics and adapting to the local dialect, including slang, work especially well. Players in Chile tend to be more conservative, so the focus should be on trust and slots that are already popular with the audience.

Communication needs to feel native. The local dialect makes a difference: in Mexico, use “tragamonedas” for slots instead of “máquinas de azar” (using it makes you stick out as a non-local). In Ecuador, casual phrases like “gana billete” work better than the stiff “gana dinero.” In Chile, the audience is more serious, so the copy should be cleaner and avoid excessive clickbait.

The region also has its taboos. Across these GEOs, formal Spanish or worse, poor translation should never be used. Overpromising is equally dangerous: mislead players once, and they won’t come back. Mexico adds its own cultural restrictions (yellow color, cats), while Chile enforces strict advertising rules, where a white-hat approach is the only way for affiliates to survive and thrive.

Why drive traffic to LATAM with PIN-UP Partners?

As we mentioned at the very beginning, it’s crucial to work only with a trusted partner and a product the audience already recognizes. That’s exactly why we’ve outlined a few key reasons to start your partnership with PIN-UP Partners.

Ready-made infrastructure for Mexico, Chile and Ecuador. No need to figure out local payment systems or support on your own: everything is already tested, analyzed, and set up. For example, if a player from Mexico makes a deposit through SPEI, the payment will go through smoothly.

Up-to-date campaign data. You’ll get access to a convenient dashboard (in your personal account at the PIN-UP Partners platform) with everything in one place: campaign stats, player metrics, financial reporting—all the data you need to optimize quickly and stay in control.

Exclusive retention funnels. PIN-UP Partners uses proven mechanics in its iGaming product to keep players coming back, making the brand their first choice among online entertainment providers. Once a user deposits, they receive personalized offers and promotions that drive return visits. The program carefully segments audiences and tailors approaches to each group.

Personal manager and support. You’ll have a dedicated manager who understands the nuances of working with the traffic in these GEOs. Need to test a new Facebook creative fast? Your manager will suggest a ready-made option or advise against it and point you to a strategy that saves both time and money.

Fast cap approvals. When your campaign is converting and you hit the daily or monthly cap, you don’t want to sit around waiting. With PIN-UP Partners, limit increases are approved quickly, so you can keep scaling traffic and monetizing momentum without losing budget.

Exclusive + localized landing pages and creatives. The affiliate program provides ready-to-use materials in Spanish, adapted specifically for Mexico, Chile, or Ecuador. No need to hunt for translators, wrestle with localization, or risk costly mistakes.

The loyalty program AffShop. It rewards affiliates not only with standard payouts but also with PinCoins, the program’s internal currency. You earn PinCoins for traffic, quests, and challenges, and then exchange them for valuable rewards from gift certificates and trips to branded clothing and exclusive merch.

Across Latin America, PIN-UP Partners works on CPA, RevShare, and Hybrid models. CPA payouts range from $20–30, depending on traffic source and terms, while crash-game approaches start at $15. For details on other models, just reach out to the PIN-UP Partners team.

How to Start Driving Traffic in LATAM?

In 2025, LATAM remains one of the most promising regions for affiliate marketing in the iGaming vertical. Mexico, Chile, and Ecuador stand out in particular, with cheap traffic and an audience that’s both eager and highly engaged. Be sure to test these GEOs. We’re confident the CRs will impress you!

And if you want to launch fast with ready-to-go setups, head over to our Telegram bot. You’ll get instant access to a personalized LATAM strategy from PIN-UP Partners.